Cash App: The Story of a Late Bird who Caught the Worm

Cash App managed to conquer a market that was owned by Paypal and Venmo thanks to their obsession with innovation speed and distribution.

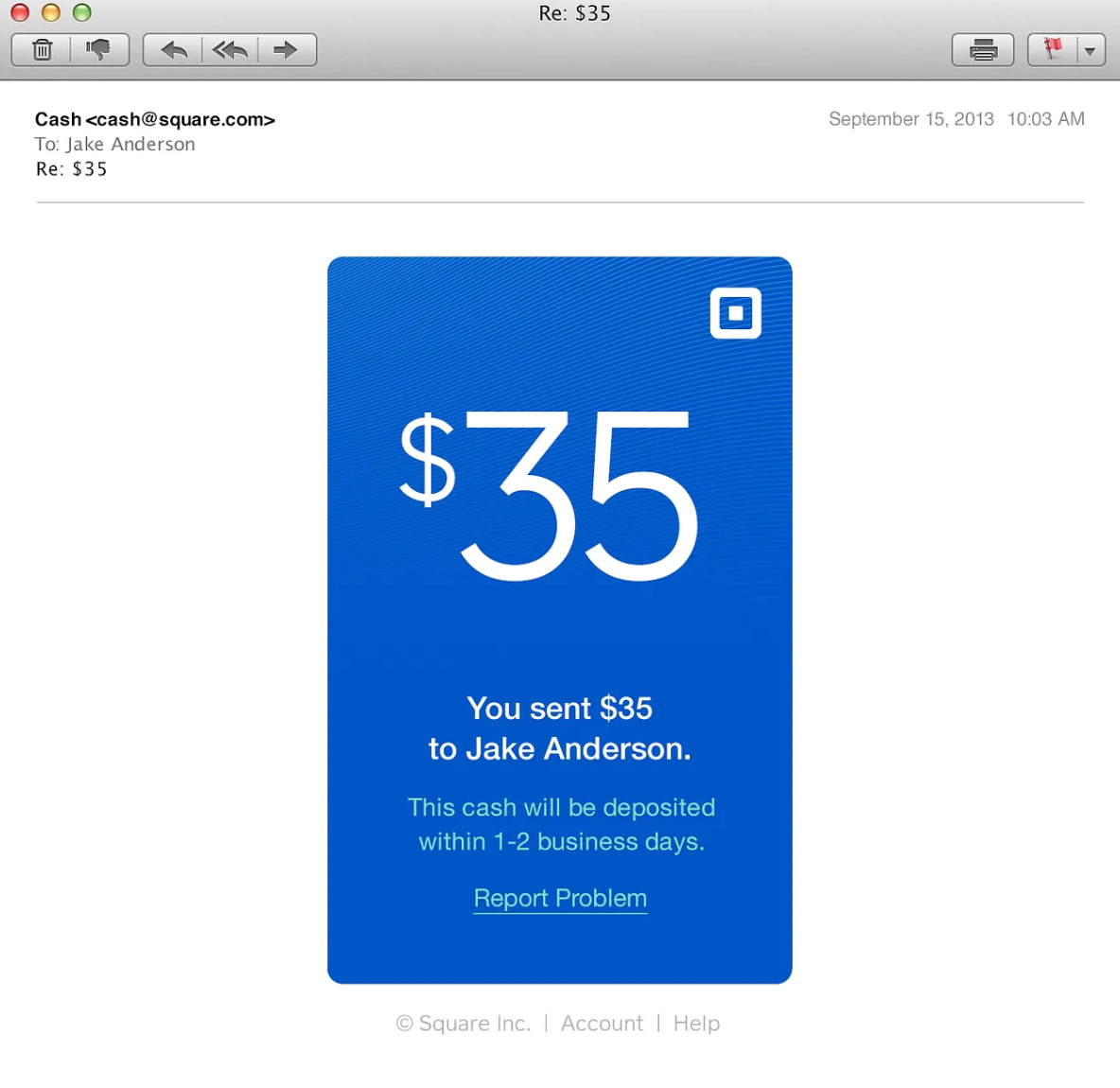

Cash App is a mobile payment service that has become a significant player in the financial technology space, particularly in the US. Launched in 2013 by Block, Cash App was initially created to facilitate peer-to-peer payments, allowing users to quickly send and receive money with just a few taps on their smartphones. Over the years, it has evolved into a super-app financial platform, offering a wide range of services beyond simple money transfers.

Cash App was the 3rd most downloaded app in the US in 2022. They have over 60 millions users and generate over $10b revenue annually. Their ARPU is $133 and CAC is at $10.

And actually the product v1 was not even an app it was an email product.

Cash App’s journey from a fledgling idea to a platform with over 60 million users is a testament to how a well-executed strategy can drive explosive growth in a competitive market.

The Early Days: Find a Niche and Target the Right Audience

When Cash App first entered the market, it was up against established giants like Venmo and PayPal. Rather than directly competing for the same users, Cash App focused on a largely underserved demographic: unbanked and underbanked individuals. This group, which includes millions of people who lack access to traditional banking services, was eager for a simple, accessible financial solution.

By initially targeting the southern United States, particularly cities like Atlanta, Cash App quickly gained traction in communities that felt alienated by traditional financial institutions. The app’s ease of use and instant deposit features resonated with these users, providing them with a faster, cheaper, and more relatable financial tool.

Product Simplicity and Accessibility

One of Cash App’s strongest growth levers was its focus on simplicity and accessibility. The app was designed to be intuitive, allowing users to send and receive money with just a few taps. This simplicity made it particularly appealing to Millenials and Gen Z, who were already comfortable with digital solutions but often found traditional banking clunky and outdated.

Moreover, Cash App introduced features like instant deposits, where users could transfer funds to their bank accounts immediately for a small fee. This feature was a game-changer, especially for users who needed quick access to their money, setting Cash App apart from competitors that took days to process similar transactions.

Expanding Services Beyond P2P Payments

While Cash App began as a P2P payment app, it quickly expanded its services, turning it into a comprehensive financial platform. The introduction of the Cash Card, a customizable Visa debit card, was a significant step. It allowed users to spend their Cash App balance directly at stores or withdraw cash from ATMs, making Cash App more than just a payment tool—it became a viable alternative to a traditional bank account.

In 2018, Cash App took another leap by enabling users to buy and sell Bitcoin directly through the app. This move not only capitalized on the growing interest in cryptocurrency but also attracted a new segment of users interested in investing. The platform later added the ability to trade stocks, further solidifying its position as a one-stop shop for financial services.

These new features significantly increased user engagement and retention. Once users were drawn in by the P2P payment functionality, they stayed for the additional services, which increased the app’s lifetime value per user.

Influencer Partnerships and Sponsored Content

One of the most distinctive aspects of Cash App’s growth strategy was its deep integration into pop culture. Early on, Cash App recognized the power of cultural relevance and partnered with influencers and celebrities, particularly within the Black community and the hip-hop industry.

For example, Cash App teamed up with artists like Travis Scott, Lil Nas X, and Megan Thee Stallion for various promotions. These collaborations weren’t just about slapping a logo on a product; they involved real engagement, such as cash giveaways directly to fans via the app. This strategy resonated deeply with their audience, making Cash App not just a financial tool, but a part of the cultural conversation.

Moreover, Cash App became a regular feature in rap lyrics, further embedding it in the culture. The app’s ability to connect with its users on a cultural level, rather than just a transactional one, significantly boosted its growth.

Viral Marketing and Low CAC

Cash App’s marketing strategy was another critical factor in its growth. The company employed viral marketing techniques that significantly reduced its customer acquisition cost (CAC). One of the most successful campaigns was #CashAppFriday, where users could win money by sharing their $cashtag on social media. This simple yet effective campaign generated massive user engagement and brought in new users at a very low cost.

By encouraging users to invite friends and family to join the platform, Cash App created a self-reinforcing growth loop. Every time someone used the app to send or request money, there was a good chance the recipient would become a new user. This organic growth mechanism allowed Cash App to scale rapidly without relying heavily on expensive traditional advertising.

Strategic Use of Social Media Ads

Social media became one of Cash App’s primary platforms for paid marketing. Cash App poured significant resources into advertising on platforms like Meta, and later, TikTok. These platforms were perfect for reaching Cash App’s target demographic of younger, tech-savvy individuals who were already comfortable with digital tools but may not have had access to traditional banking services.

This UGC generated over 72M impressions in 2022 showing how simple and easy to understand content worked wonders for CashApp

In 2022, Meta accounted for the majority of Cash App’s ad impressions. Cash App’s ads on these platforms were highly targeted, focusing on the specific needs and desires of its audience. For example, many of the top-performing ads highlighted the Cash Card, a customizable Visa debit card linked to the app. This feature was not just functional but also allowed users to express their individuality, which resonated strongly with Cash App’s young user base.

These ads weren’t just about flashy visuals—they were effective. In 2021, Cash App acquired new active users at an average cost of just $10 per user. Considering that these users often went on to use multiple features within the app, this low customer acquisition cost translated into a high return on investment. Over a three-year period, Cash App saw a more than 6 ROAS on its paid marketing efforts.

Experimenting with New Advertising Channels

As Cash App grew, it began experimenting with new advertising channels to continue scaling its user base. One such experiment was Connected TV advertising. In 2022, Cash App launched its first CTV ad starring tennis legend Serena Williams. This ad ran on streaming platforms like Hulu, Tubi, and ESPN+, targeting a broader audience that might not be as active on traditional social media platforms.